Trend Analyser

Trend Analyser is a professional charting and analysis software that comes with state-of-the-art tools to determine trend, momentum, buy and sell points for stocks.

The product is developed for today's markets which are volatile and tricky at times. Scroll below to see a list of features.

• Multiple Chart Types: Candlestick, OHLC, Renko, Kagi, Range Bar, Line

• Drawing Tools: Trend lines, Fibonacci, Channels, Support/Resistance

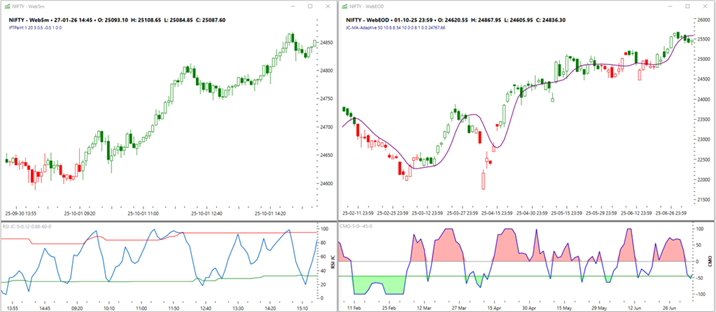

• Multi-Window Support: Multiple charts with different symbols/timeframes

• Customizable Themes: Light and dark themes with custom colors

• Chart Presets: Save and load favorite configurations instantly

• Smooth Zooming: Pan and zoom through years of data instantly

• Trend: Moving Averages (SMA, EMA, KAMA), SuperTrend, Ichimoku, ADX

• Momentum: RSI, MACD, Stochastic, CCI, CMO, Williams %R, ROC

• Volatility: Bollinger Bands, ATR, Keltner Channels, Normalized ATR

• Proprietary: Adaptive RSI, Zero Lag Filters, Schaff Trend, IFT

• Multi-Timeframe: 5min, 30min, Daily, Weekly, Monthly analysis

• SignalPacket Architecture: Modern two-phase execution model

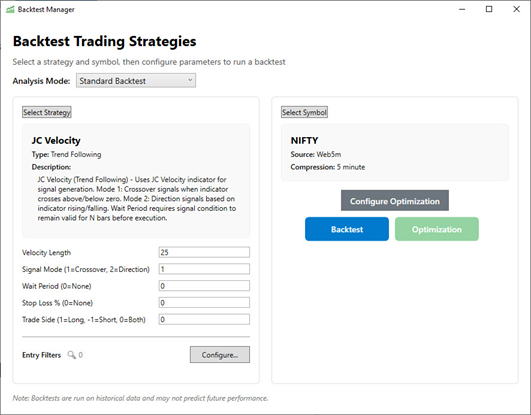

• Built-In Strategies: MA Crossover, RSI, Stochastic, ORB, MACD, ADX

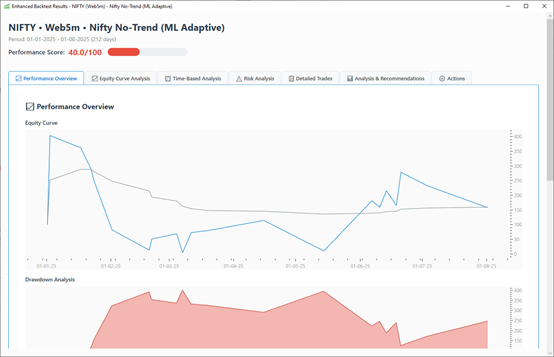

• Comprehensive Metrics: Net Profit, Win Rate, Profit Factor, Max DD, Sharpe

• Equity Curve Visualization: Performance over time with trade markers

• Parameter Optimization: Grid search for optimal indicator settings

• Long/Short/Both Modes: Test any trading direction

• Trade Analysis: Detailed breakdown of every trade

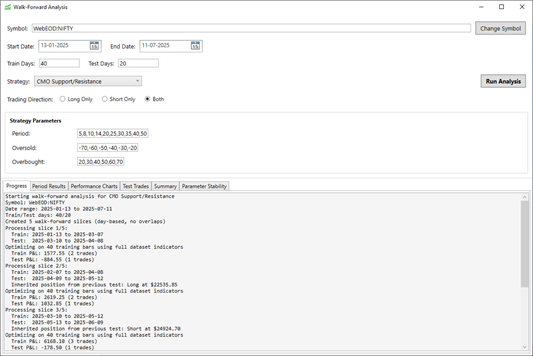

• In-Sample / Out-of-Sample Testing: Validate on unseen data

• Rolling Window Analysis: Re-optimize as markets change

• Bar-Based WFO: Universal timeframe support, ideal for intraday

• Date-Based WFO: Modular indicator rule system with daily optimization

• Robustness Metrics: Compare IS vs OOS performance

• Anchored vs Rolling Modes: Fixed-start or sliding windows

• Performance Degradation Analysis: Detect failing strategies

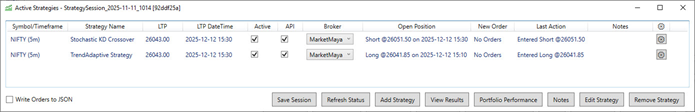

• Multi-Strategy Sessions: Run multiple strategies simultaneously

• Live Position Tracking: Real-time P&L updates

• Session Management: Save, load, switch between sessions

• Portfolio P&L Dashboard: Aggregate view of all positions

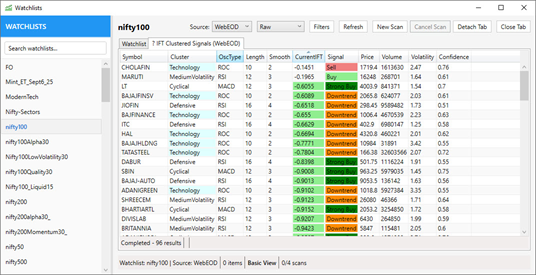

• Strategy-Based Scans: Run any strategy across entire watchlist

• Technical Filters: Filter by indicators, price action, volume

• ORB Scanner: Find stocks breaking out of morning range

• Multi-Window Analysis: Analyze across different lookback periods

• Clustered IFT Scan: Advanced Inverse Fisher Transform scanning

• Concurrent Processing: Parallel scanning for maximum speed

• Custom Watchlists: Scan your own symbol lists

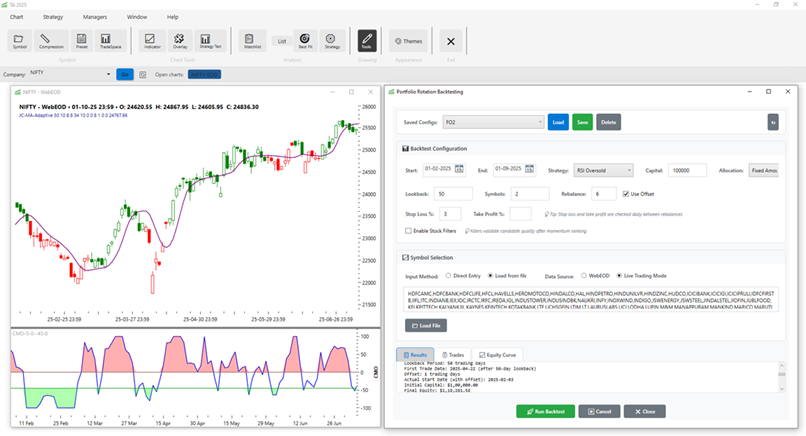

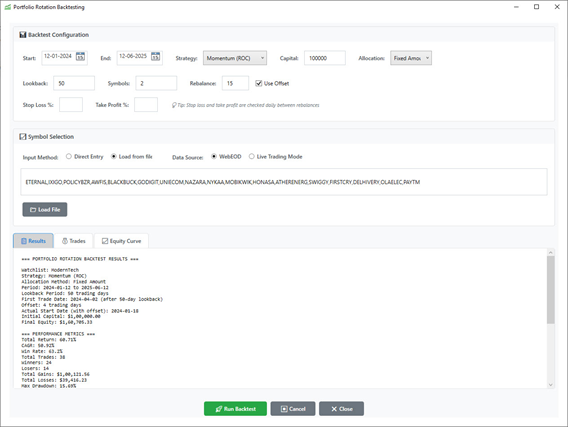

• Momentum-Based Rotation: ROC-based stock selection

• RSI Strategies: Rotate into oversold, exit overbought

• Market Regime Detection: HMM-based regime filtering

• Multi-Symbol Backtesting: Test across entire watchlists

• Position Sizing: Equal weight or custom allocation

• Configurable: Lookback, holdings count, rebalance frequency

• Performance Attribution: Understand return contributors

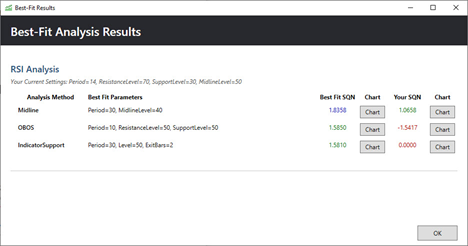

• Grid Search: Test thousands of parameter combinations

• Multiple Rules: ZeroCross, OBOS, Indicator Support trading

• SQN Metric: Van Tharp's System Quality Number

• Compare Settings: See current vs optimal parameters

• Interactive Charts: Visualize trades from optimized params

• One-Click Analysis: Select indicator, click Best Fit and see results

• Hidden Markov Model: Identify market states statistically

• 6-Feature Analysis: ATR, CMO, ADX, KAMA, RSI, Bollinger

• Regime Detection: Bull, Bear, Sideways, Breakout, Consolidation

• Symbol Clustering: K-Means grouping by technical characteristics

• Technical Profiling: Volatility, Trend, Mean Reversion analysis

• Time Bucket Analysis: Identify optimal trading times

• Cluster-Based Adaptation: Auto-adjust strategy by stock type